The hidden cost of moving crypto liquidity across protocols

Part of our ‘Liquidity issues in crypto’ series, this article looks at what happens when liquidity providers lose efficiency when reallocating liquidity across pools.

In DeFi, crypto liquidity rarely stays in the same place for long. Volume shifts between liquidity pools, fee tiers change and order flow gets routed elsewhere.

But while spotting a better opportunity can be easy, acting on it is not. Moving liquidity across pools introduces friction that quietly can reduce realized returns.

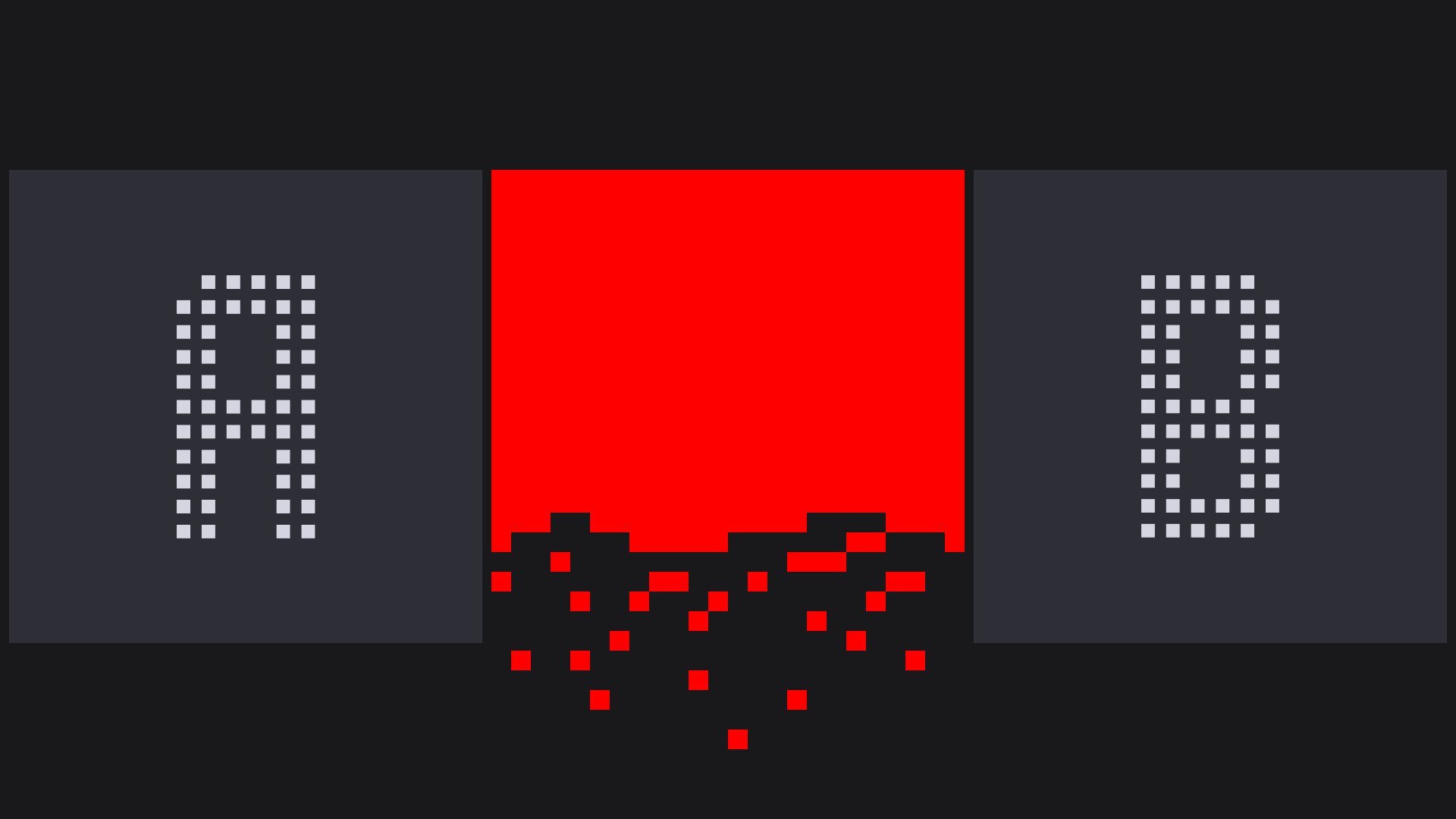

Reallocating liquidity across pools is a multi-step process

For a liquidity provider, this reallocation process is a common liquidity issue in crypto markets that is not always fully accounted for.

A typical reallocation includes:

- exiting a liquidity pool

- paying transaction fees

- approving tokens for a new contract (often required when switching protocols)

- entering a new pool or strategy

- configuring parameters such as ranges or weights

Each step adds cost and complexity. Even when every decision is correct, the process itself can create friction. This is not about poor strategy. It is a structural issue that stems from crypto liquidity being fragmented across separate pools and protocols. The extent of this friction depends on strategy, timing and market conditions.

Transaction costs add up when moving liquidity across pools

The most visible cost of moving liquidity is transaction fees. For a crypto liquidity provider who rebalances occasionally, these costs may seem manageable. But for more active strategies, they recur every time conditions change. Over time, recurring costs may erode margins in some strategies or fee environments, especially when rebalancing is frequent.

Potential slippage and price impact during reallocation

Another hidden cost shows up at the moment liquidity is moved. While adding or removing liquidity happens at the pool’s current price, reallocation often requires swaps to rebalance token amounts or enter a different pool. Those swaps can introduce:

- slippage

- unfavorable execution prices

- price impact, especially in thinner markets or for larger orders

In concentrated liquidity pools, moving ranges changes token composition, so swaps are often needed to redeploy efficiently. In smaller or thinner liquidity pools, this execution friction can become more pronounced.

Where impermanent loss matters and where it doesn’t

Impermanent loss is not a cost of moving liquidity by itself. It is a risk that exists while liquidity is deployed and relative prices move.

Reallocation, however, often requires closing a position. When that happens, any accumulated underperformance versus holding is effectively locked in at the exit price. Frequent moves can repeatedly crystallize outcomes and restart exposure in a new position.

For LPs who rebalance often, this can quietly reduce long-term performance, even when each individual move seems justified. Impermanent loss is not the core issue here, but it can amplify the drag created by frequent repositioning. The extent of these effects depends on rebalancing frequency, market volatility, fees and the LP’s strategy.

Frequent range moves can increase how often position outcomes are locked in, especially when redeployment requires rebalancing swaps.

How Aqua reduces liquidity reallocation overhead

Many of these costs share the same root cause: liquidity is fragmented across pools and protocols, so reallocating capital usually means closing one position before opening another. Each transition may introduce overhead, approvals, execution steps and time not deployed.

Aqua’s shared liquidity approach represents a new category of crypto liquidity solutions intended to reduce this friction by allowing the same balance to support multiple strategies through a single liquidity layer. How much friction is reduced depends on how strategies are implemented and how market and routing behavior evolve.

1inch Aqua is a shared liquidity layer where tokens remain in the LP’s wallet under self-custody, and strategies can pull and return assets within a single atomic flow when their conditions are met. With one approved balance available to multiple strategies, most of the repeated exits, approvals and re-entries associated with migration become unnecessary. Liquidity can be rebalanced across strategies through smart contract logic based on user-defined parameters, helping to minimize unnecessary swap-driven slippage and price impact.

Aqua is currently available to developers, with SDKs and documentation published on GitHub. Builders can use the 1inch Aqua Protocol today, while improvements to the shared liquidity layer continue to be developed.

For more insights from 1inch, subscribe to our newsletter!

Recent Posts

Crypto checkouts in the US move from “pilot” to “default”

A new report produced for PayPal says 39% of US small and medium-sized businesses already accept crypto payments, while another 27% plan to add it soon.

1inch heads to ETHDenver

Next week, the ETH community converges on Denver - and 1inch will be there, showcasing its latest tech and pushing DeFi forward.

Alvara’s Basket Lab integrated 1inch’s Swap API to expand token liquidity options

The partnership leverages Alvara’s ERC-7621 standard to facilitate token diversity in on-chain portfolio management.