What’s the difference between Market and Aggressive gas settings

Market and Aggressive gas price settings let users control transaction speed and cost when swapping tokens.

When performing swaps on Ethereum or other EVM-compatible networks, the gas cost determines how fast a transaction will be confirmed. Gas represents the cost of using network resources: paying more usually means faster processing, while lower fees may take longer.

How gas prices are formed

On Ethereum and most EVM-compatible chains, the total transaction fee equals the gas used multiplied by the effective gas cost. This cost is determined when the transaction is included in a block and consists of two parts: the base fee, which fluctuates with network congestion and is burned, and the priority fee, or tip, paid to validators to encourage faster inclusion. The max fee defines the upper limit of what can be spent, and any unused difference between the max fee and the actual cost is automatically refunded.

Faster confirmation generally depends on setting a competitive priority fee and a max fee high enough to cover both the base and priority fees at the time the block is produced.

Gas settings on 1inch

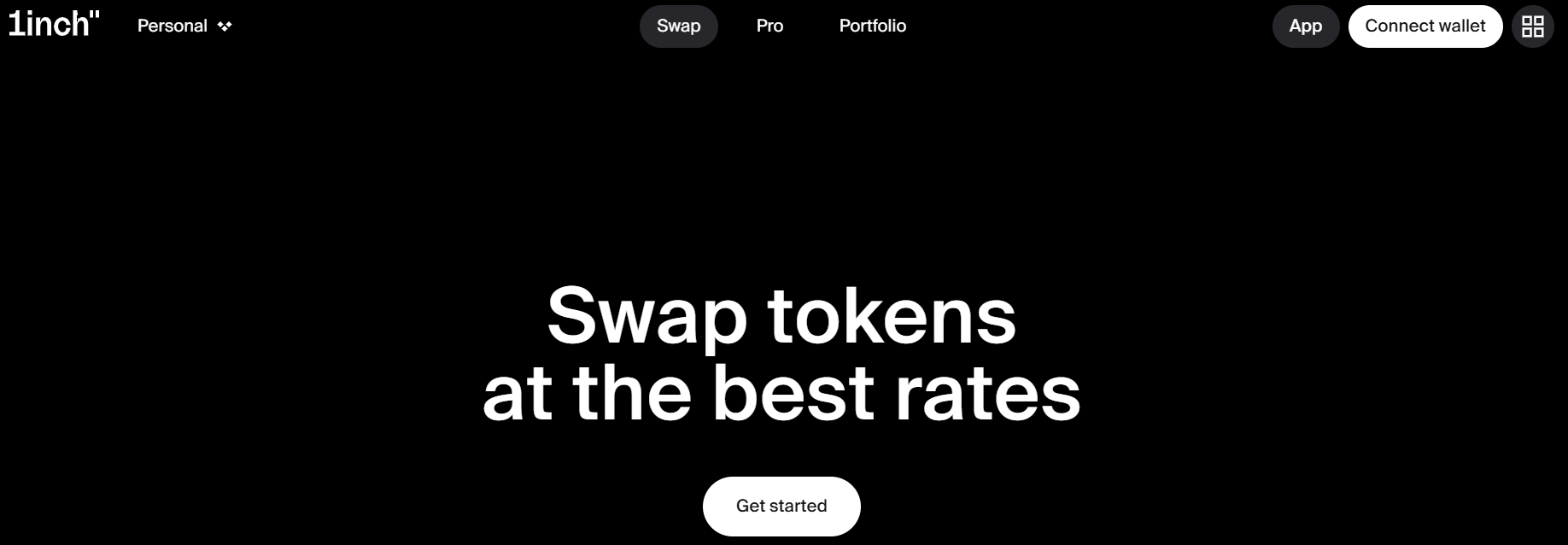

All gas-related settings can be managed directly in the Pro interface of the 1inch dApp. Here, users have two options for gas strategy: Market and Aggressive. These determine how much they are willing to pay for the transaction to be processed and how quickly it will be confirmed.

Market gas price

The Market option reflects the current average gas price at the moment of execution. It is the rate used by most transactions and typically provides a balance between speed and cost.

Aggressive gas price

The Aggressive option applies a higher gas price, giving the transaction priority in the network queue. It is useful when quick confirmation is needed, for example during periods of heavy network activity or fast price changes.

In short:

- Market provides a standard gas price for balanced efficiency

- Aggressive offers faster execution at a higher cost

How to use gas settings on 1inch

In 1inch Pro, users can adjust gas preferences before confirming a swap. These gas settings apply to Market swaps, which use the 1inch Aggregation Protocol to find optimal routes across decentralized exchanges, ensuring efficient pricing, low slippage and secure execution.

- Go to 1inch.com/pro and connect a wallet.

- Switch to the Market tab.

- Select the token pair to swap.

- Enter the desired amount.

- For buying, enter the total tokens to receive.

- For selling, enter the amount to swap.

- Choose the preferred gas fee strategy (Market or Aggressive).

- Review the details, approve if needed, and confirm the swap.

For users who prefer not to adjust gas settings manually, 1inch also offers gasless swaps in the Swap interface, including cross-chain swaps, which operate without bridges.

For those seeking more control, 1inch Pro provides detailed customization of gas settings and other parameters for an advanced, flexible experience.

Stay tuned for more guidance as we continue answering key questions about 1inch and Web3!

Recent Posts

1inch in January: Rewardy, OneKey

January focused on reach. New partnerships with Rewardy and OneKey put 1inch’s core products into more wallets across key regions, while the team also took part in the CFC St. Moritz Industry Days in Switzerland.

Almost three quarters of DeFi users optimistic about 2026 - 1inch survey

Findings of a survey recently conducted among over 8,000 individuals by 1inch, Bitget Wallet, Ondo, BOB, DaGama and SafePal reveal an optimistic outlook on crypto in 2026.

Who gets tokens? Unpacking DeFi distribution models

Token distribution and rewards drive incentives, engagement and long-term stability in DeFi.