1inch’s Sergej Kunz: DeFi faces a liquidity crisis

Speaking at Devconnect Argentina last month, 1inch co-founder Sergej Kunz said that huge amounts of liquidity sit idle in DeFi - an issue that 1inch’s Aqua protocol sets to solve.

DeFi was built on the promise of open, efficient markets. But today, that efficiency exists mostly on paper. The vast majority of capital sitting in major liquidity pools simply isn’t doing any work.

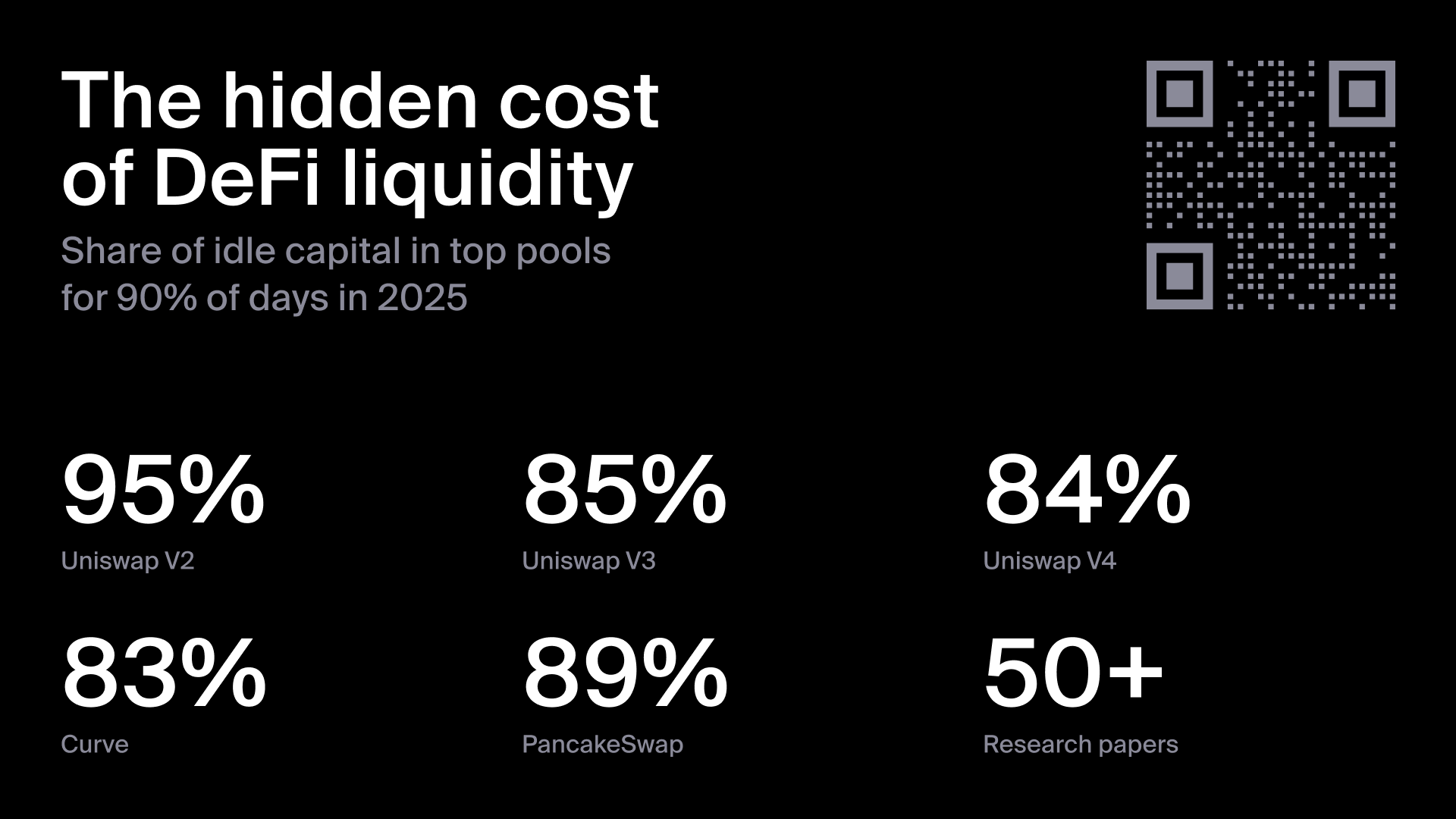

Between 83% and 95% of liquidity in top pools - across Uniswap v2, v3, v4 and Curve - sits idle most of the year, Sergej said in his keynote address at Devconnect Buenos Aires, quoted by Coindesk. He added that this state of DeFi amounts to a “DeFi liquidity crisis.”

Billions of dollars remain locked in smart contracts without earning fees or generating meaningful returns. In Uniswap v2 alone, only 0.5% of liquidity usually falls within active trading bands, leaving nearly $1.8 bln effectively dormant.

You can scan the QR code above to explore the data on idle DeFi liquidity in the Dune dashboard.

According to Sergej, this inefficiency primarily hits retail users, with roughly one half of liquidity providers losing money once impermanent loss is factored in. One Uniswap v3 pool alone saw over $30 mln in lost profits due to Just-in-Time (JIT) liquidity manipulation, he observed.

The root issue of this liquidity situation is fragmentation. DeFi has more than seven million pools scattered across protocols and networks. Liquidity is sliced into countless isolated buckets, making it more difficult to route trades efficiently and lowering returns for LPs.

A new approach to fixing idle liquidity

To 1inch, the answer is shared liquidity - capital that can power multiple strategies at once, without being locked inside individual contracts. That’s the idea behind Aqua, 1inch’s new liquidity protocol, which had a developer release last month.

According to Sergej, Aqua’s concept is simple but game-changing, as it’s set to lead to less fragmentation, higher capital utilization and more efficiency across the DeFi space.

“With Aqua, users don’t have to lock assets in separate pools,” Sergej was quoted as saying by BiInCrypto. “Assets stay in the wallet and can support multiple strategies at the same time. Think of it as a virtual DEX engine running inside your wallet, while remaining fully self-custodial."

Aqua will change the assumption that liquidity must be fragmented across dozens of pools. Instead, it lets one balance behave like several without compromising security - a totally unique concept for DeFi.

"This is a new architectural model in DeFi,” Sergej said. “In 2019, 1inch solved fragmentation for takers with aggregation. Aqua solves fragmentation for makers, the liquidity providers."

He added that shared liquidity enables far higher utilization than traditional AMMs, which require liquidity to be split across pairs. With Aqua, the full balance can work across several strategies at once. Early back tests already showed yield increases of up to 5x, further amplified when liquidity is shared.

Aqua also aims to lower the barrier for developers integrating deep liquidity. “Any existing DEX right now can be implemented under 10 lines of code,” Sergej noted, explaining that the goal is to provide “a foundation to build on top” so liquidity providers can “hold assets in the wallet” rather than scattering funds across isolated pools.

The path forward

Aqua’s goal is simple: turn idle liquidity into active capital and make DeFi more efficient for everyone - from users to builders to liquidity providers.

DeFi doesn’t lack capital. It lacks the ability to use it efficiently. With Aqua, 1inch aims to change that.

Stay tuned for more insights from 1inch!

Recent Posts

Who gets tokens? Unpacking DeFi distribution models

Token distribution and rewards drive incentives, engagement and long-term stability in DeFi.

TradFi gets serious about DeFi

In 2025, many major financial institutions either shipped on-chain products that can be used in DeFi, or publicly laid out plans to do so. In this post, we’re looking at major TradFi institutions that either adopted DeFi last year or announced plans to do so.

NYSE explores blockchain for Wall Street

The New York Stock Exchange (NYSE) is building a blockchain-powered trading platform that could allow tokenized U.S. equities and ETFs to trade 24/7 with potentially near-instant settlement.